Content

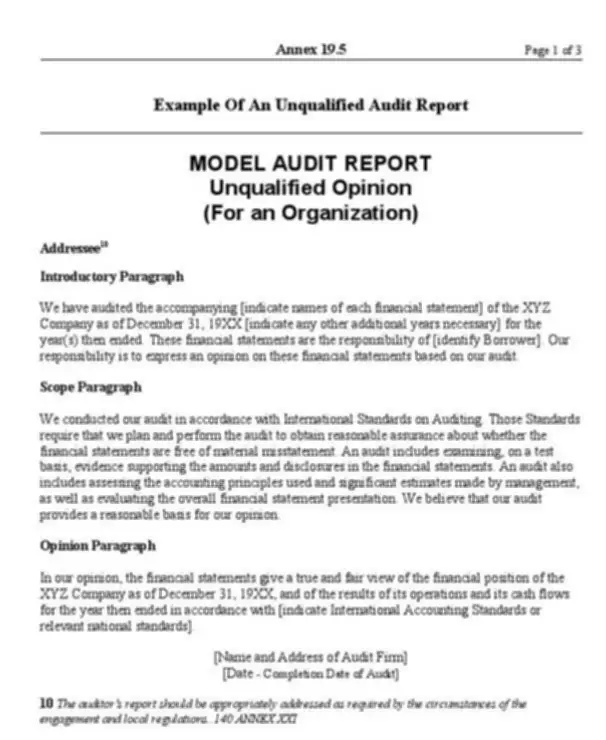

On the other hand, an audit is a systematic and independent examination of an organization’s financial statements and records to ensure that they are accurate, reliable, and comply with relevant accounting standards. In this case, a forensic accountant might work closely https://www.bookstime.com/ with the accounting assurance team that knows clearly about financial loss. Sometimes, the lawyer or court must have someone who has special skills in accounting and investigation skills to examine and produce the report on the areas related to accounting.

The investigation report could also include the cause of Fraud, which involves, and how the Fraud happens. They could also be witnessed over the accounting records related to the shareholder dispute. Interested in learning more about accounting and gaining accounting skills? The salaries listed in the Salary Guide reflect starting pay only and are based on actual placements throughout the United States, as well as an analysis of the demand for the role, the supply of talent and other market conditions. Starting salaries can vary widely from city to city, and the Salary Guide provides breakdowns for compensation trends in various locations.

What is the difference between a CPA and a forensic accountant?

A large number of BI claims stem from natural disasters, such as hurricanes, tornadoes, or wildfires. Others come from everyday events, like machinery breakdowns, product recalls, workplace fires, or explosions. This type of accounting can have major advantages for detecting financial crimes and can help many shareholders as well as legal authorities to identify any possible malpractices affecting the interests of the company. It also allows companies to have a closer look at the legal issues surrounding fraud cases, which could prove to be very costly for the business and result in enormous losses. It can help to simplify the litigation process as well as keep track of any malpractices within the company. Forensic accountants analyze financial records and accounts that may be used as legal evidence and often testify in court cases as expert witnesses.

What are the two main types of forensic audit?

Financial Statement Audit and Financial Due Diligence Audit are the two types of forensic audit.

If financial disputes cannot be resolved in ordinary negotiations between individuals or businesses, things may end up in mediation, arbitration, or even the courtroom. Forensic accounting is the investigation of fraud or financial manipulation by performing extremely detailed research and analysis of financial information. Forensic accountants are often hired to prepare for litigation related to insurance claims, insolvency, divorces, embezzlement, fraud, skimming, and any type of financial theft. Occasionally, a court case will capture the public’s imagination and become of great human interest even to those who normally pay no attention to legal proceedings.

Provide Litigation Support

The accountant that is already versed in the case will utilize the “bulls-eye” approach to review the documents. This approach allows the forensic accountant to analyze top-level summary reports. Feedback is provided, and then counsel and the accountant can determine if the next level of review is warranted.

What is a real life example of audit?

When one employee totals up all payments collected for the day — e.g., debit, credit card, cash and check payments — he must log all information on the daily cash report. Later, if another employee checks the report to see if all numbers match the report, she performs a basic audit of the cash report.

In the accounting profession, there are many paths you can take to make your career your own. Forensic accounting is one option that sometimes gains intrigue and attention with those starting their accounting careers or when evaluating new directions. We’ve all been pulled in by popular television shows like the CSI series, but what do forensic accountants really do? Below we help answer these questions and give a high-level overview of the types of work a forensic accountant might perform. Forensic accountants work with their clients and their attorneys to help develop the best strategy to resolve the situation.

Analytical techniques

Finally, it is critical for the forensic accountant to attend the deposition so that during breaks he can provide feedback to counsel. A trained forensic accountant is aware that he is not an active part of the deposition, and should only interact with his counsel. You need a CPA license to qualify for the specialized test leading to the certified in financial forensics (CFF) designation. Forensic accounting blends auditing, accounting, and investigatory skills to assess financial documents.

The typical explanation in a case like this would be that the firm had been channel stuffing—inflating sales numbers by encouraging resellers to take on inventory without selling it to end users. MDD Forensic Accountants refers to one or more of s MDD International Limited, a UK private company limited by guarantee (“MDD-International”), its network of member firms, and their related entities. MDD International and each of its member firms are legally separate and independent entities. MDD International does not itself engage in the provision of services to clients. Corporate fraud, insider trading, 9/11, intellectual property infringement the list goes on as to instances where parties have committed acts resulting in financial losses. The legal challenge in proving financial wrongdoing is a minefield in itself, but what steps need…

What Is a Forensic Accountant?

As you leaf through a box of documents just delivered, you pull out a stack of financial statements and, like so many other attorneys, you cringe. The most common response I hear from business owners who are victims of employee fraud is “I never thought this would happen to me”. Employee theft, especially in the automotive industry, is common, because small businesses such as car dealerships…

There are many different types of liability coverage available to business owners including D&O liability, professional indemnity and public liability amongst others. However, from a claims perspective, one of the most common types of cover we come across is that… In other cases, clients seek the advice of forensic specialists for internal reasons. Clients may want independent assessments of their own financial records.

What is Forensic Accounting?

Prior to the deposition, counsel should have the forensic accountant brainstorm and provide a list of questions for additional follow-up. Obviously, different cases and different attorneys warrant different strategies at deposition. The forensic accountant will merely provide a list of inquiries and counsel will determine if the inquiries are appropriate for the deposition. It takes a holistic view of financial statements and traces the movement of money in order to understand a particular situation. They may have to analyze the lifestyles of people to determine levels of spousal or child support. It’s our job to make the insured party whole or what we refer to as ‘What would’ve been, but for…the loss’ meaning ‘What would’ve been the performance of the business if this event hadn’t happened?

- You also have to stay on top of the financial industry and markets to know how changes, such as new or updated regulatory compliance mandates, can affect the finances of a company or individual.

- Forensic accountants use these skills to conduct an accounting analysis of an individual or business.

- The primary objective of an audit is to provide an opinion on the financial statements, highlighting any material misstatements or weaknesses in internal controls.

- It also uses a number of accounting skills such as auditing to discover if a financial crime has been committed.

- Forensic engineers, on the other hand, try to find out what went wrong with a structure or machine.

- They use information from these fields to detect, unearth, and present evidence of fraud to the public.

To best serve the client, and to properly develop the case, a detailed analysis of relevant financial data is required. In fact, identifying the records to be reviewed and analyzed is paramount to proper preparation of the case. Accountants who perform forensic accounting must possess strong math skills and an investigative mindset. Forensic accountants must know not only how to analyze complex financial statements, but also how to spot signs of illicit or negligent activity. As a consultant, a forensic accountant may be hired by an attorney to assist in collecting, analyzing, and interpreting financial information that is pertinent to a given case.

Forensic Accounting Procedures for Fraud Related to Purchasing

There are many other areas of financial records that a forensic accountant that is trained to look behind the numbers can provide clarity to. The journey to a forensic accounting career begins with a bachelor’s degree. Most aspiring accountants major in accounting, finance, economics, or a closely related subject. Forensic accountants in these roles work to uncover evidence of criminal activity. They also investigate national security threats by tracing the sources of financial support for criminal or terrorist groups. We also worked with our client’s attorney and insurance company to file a claim and recover the maximum amount possible.

They organize investigations, analyze available financial data, share their findings, and educate you on the available courses of action. Forensic accounting is a specialized area of accounting that focuses on investigating financial crimes, disputes, and other irregularities. Because forensic accountants are independent experts, they are preparing the expert report, but they also could be the witness used by the court. Forensic accountants analyze whether a crime occurred and assess the likelihood of criminal intent. Such crimes may include employee theft, securities fraud, falsification of financial statement information, identity theft, or insurance fraud.

Product Liability Claims: How can a forensic accountant assist in the claim review process?

The definition of forensic science is the application of scientific principles and techniques which are suitable for use in court. Likewise, forensic accounting is a specialty practice area of accounting that describes engagements example of forensic accounting that result from actual or anticipated disputes or litigation. Specialists in forensic accounting are the detectives of the finance world. They use their expertise to investigate fraud, embezzlement, and other white collar crimes.

- Insurance company stocks have been some of the worst performing since the virus went, well… viral, in anticipation of declines in profits due in part to COVID-related claims.

- For example, if the seller represents that they have $1 million in accounts receivable, we ask ‘How old are those receivables?

- While income statements and balance sheets are integral to contextualizing reported revenue and asset pricing, a company may present them in ways that don’t reflect the company’s true value.

- Investigative techniques can also be employed on a preventative basis to form systems to detect fraud or prevent fraud from occurring in the first place.

- Forensic accountants must stay on top of emerging schemes and issues, remain technologically literate, and always remember that fraudsters are one step ahead.